The Office of Attorney General reached a settlement with Express Homebuyers to resolve our lawsuit against the company for its deceptive letters claiming that homeowners were at risk of foreclosure and owed back taxes. The company will pay $70,000 in penalties to the District.

In March, a judge granted our temporary restraining order against Express Homebuyers requiring the company to send the below alert to all District residents that received the letters. Additionally, the company was barred from creating advertisements that violate District law, and advertising, promoting, or engaging in for-profit foreclosures rescue services.

Read the settlement agreement here. And read more in the consumer alert below.

December 23, 2021 Consumer Alert

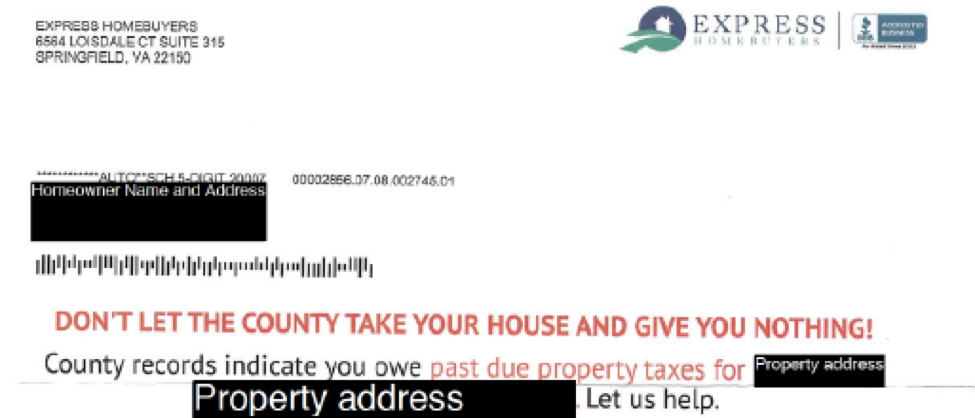

Have you received a letter from Express Homebuyers claiming that you owe past due property taxes and must act quickly to prevent your home from being lost to tax sale or foreclosure? OAG has filed a lawsuit after learning Express Homebuyers sent these letters to District homeowners without any actual knowledge that the homeowners owed property taxes. The lawsuit also alleges that Express Homebuyer’s letter misrepresents the D.C. tax sale process, which provides notice and redemption opportunities for property owners.

Excerpt from Letter:

Should I be concerned?

Please disregard any letter that you may have received from Express Homebuyers regarding your property taxes. Express Homebuyers may not have accurate information regarding your property tax payment status, and they are not affiliated with the District of Columbia government in any way.

If you would like to check the status of your property tax payments and verify whether you are current, you may do so for free by contacting the D.C. Office of Tax and Revenue at (202) 727-4829 or searching the D.C. Office of Tax and Revenue’s online property tax database at mytax.dc.gov.

If you have experienced any problem regarding Express Homebuyers or have received similar letters from other companies, call OAG’s Office of Consumer Protection at (202) 442-9828, submit a complaint at consumer.protection@dc.gov, or fill out an online form.

To view the Complaint OAG filed against Express Homebuyers, click here.